~ 9 min read

Comparing VAT Solutions for Bootstrapped UK Businesses

Laws on when to apply VAT have always been a complex beast - in 2015 the EU made changes that meant that VAT was to be calculated based on a customer location, introducing a VATMOSS system for its collection. Since leaving the EU things have become even more complicated if you happen to be based in the UK. You now are no longer able to make use of the VATMOSS system, meaning you potentially need to register for VAT in every EU country you sell products to (!). The Governments current angle seems to be to suggest that UK businesses register their companies for VAT MOSS in another EU Country in order to ease the burden of correctly complying with VAT regulations.

Any EU business that uses the VIES lookup tool for validating VAT numbers will now no longer work for a UK business meaning my business has been charged VAT where it isn’t necessary. If all that wasn’t enough, theres the possibility of credit card fraud, chargebacks and the accounting complications that come with selling software internationally.

It’s difficult to know how to proceed with business ideas these days as a solo founder when payment providers - such as Stripe have yet to handle many of these issues for us. We don’t really want to run the risk of charging an incorrect amount, but the rules for VAT are probably more complexity than we’d like to handle ourselves. I recently asked the question on twitter and it sparked quite a lot of interest, so here I’m going to summarise what I learned.

Kind of confused how smaller indie businesses in the UK handle this? How are you ensuring your company is correctly complying with UK laws on VAT/billing for SaaS/products since Brexit? @IndieHackers

— Ian Wootten (@iwootten) February 9, 2021

Ultimately, there are a few tried and tested routes being followed by developers to getting paid online. I’ve divided these into two categories, what I call “revenue systems” and “develop it yourself” systems.

Revenue Systems

These systems focus on providing an all-in-one checkout solution where the customer purchase is between the platform itself and the customer, rather than your business and the customer. They can handle both the checkout experience and tax calculations and pay a single lump sump each month.

Unfortunately, if you happen to be in the UK and checkout using one of the revenue systems, you’ll actually have VAT applied to to your purchases in some cases where it shouldn’t apply (e.g. Ebooks). I mentioned this recently on twitter to Gumroads founder Sahil and will update if I hear back, but it seems the problem is the same with all providers where they base tax calculations solely on the location and not the product type as well. I’m not sure where this places your business as far as the HMRC are concerned. A DIY approach could therefore be a better solution if you’re selling ebooks to those in the UK depending on your scale. You’d have to be doing very well for it to make sense though.

Gumroad

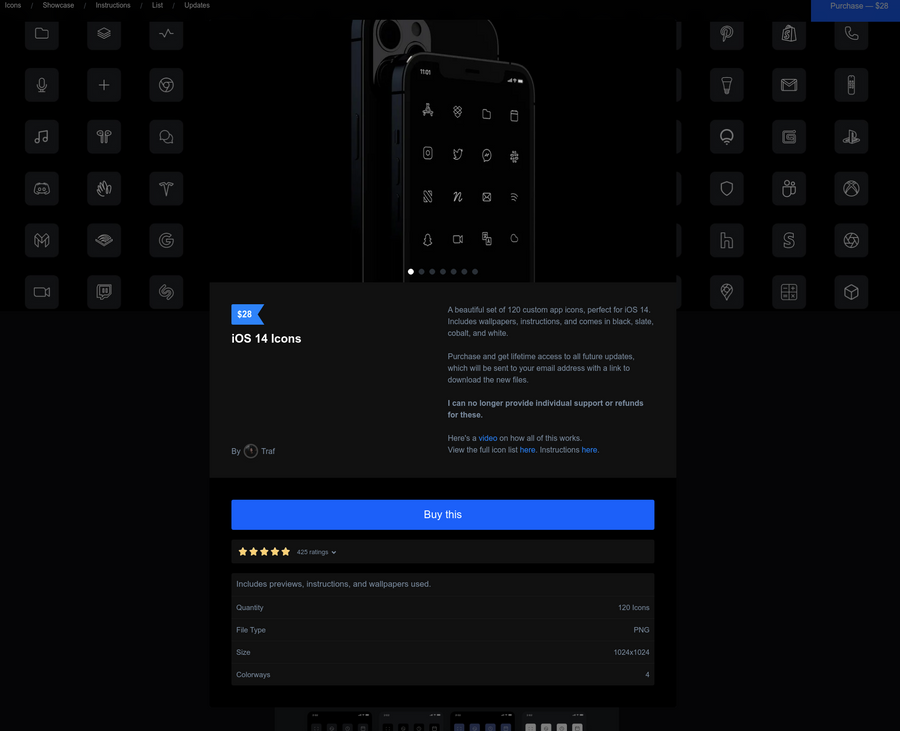

Gumroad is used by multiple well known profile solo businesses such as Daniel Vassallo (who is also employed by Gumroad) and Alex Ellis. Recently the designer James Traf made a huge $280k in just four weeks using Gumroad.

Gumroad seems to be the main choice for digital product creators. Gumroad states that they are able to handle VAT completely, to allow the author to focus on producing content only. It deals with the distribution and payment of your product, meaning there is seemingly very little to worry about and only charges fees when you make money. Gumroad is able to create “Memberships” as shown by Daniel Vassallo’s Profit and Loss subscription newsletter. These features are ideally targeted to creators though, rather than a SaaS. Gumroad states “The Gumroad customer experience is designed to be a 1:1 transaction. You pay money, and you get a product immediately - a PDF, Photoshop brushes, a movie, etc.”.

Pricing for Gumroad is 5% + a charge fee of 3.5% + 30c and then $10/mo where the charge fee applies only.

Paddle

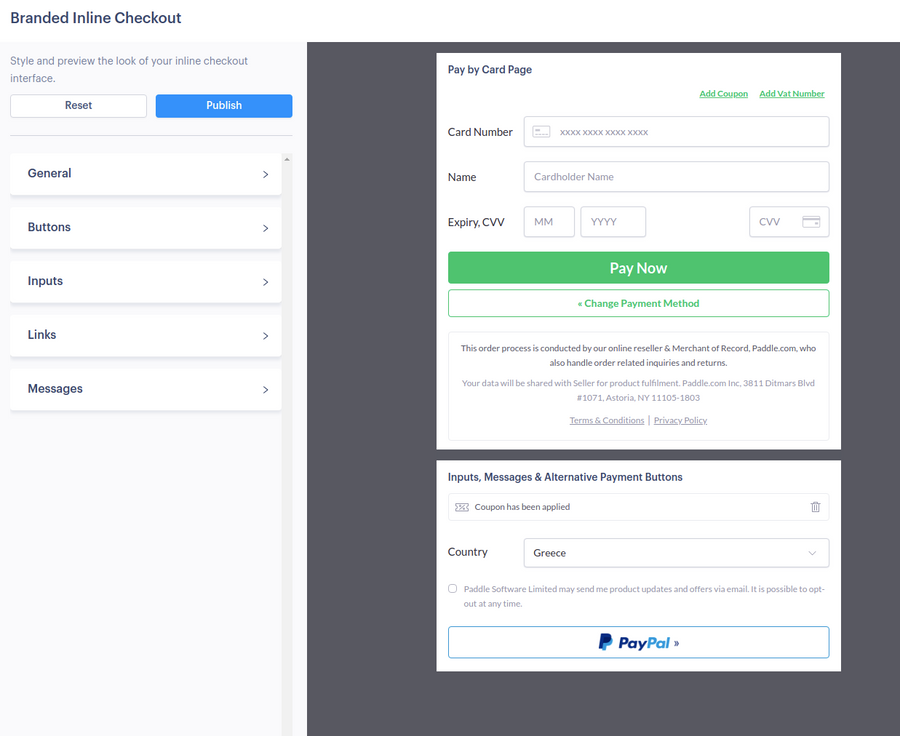

Paddle is a more traditional billing solution that also handles calculations of VAT and Taxes owed on your behalf. It behaves as a “Merchant of Record” or a reseller of your software that processes your customer transactions. This means that your customer only ever makes purchases from Paddle, rather than your company directly.

You can use their preferred overlay style layout or integrate into your own website via Paddles API. Their overlay is able to be customised to match your own branding.

I have some experience of using Paddle myself for a product I failed to launch in the vfx world. It specifically notes that is targeted at B2B SaaS subscriptions, which is the opposite to Gumroad. Using the two in conjunction with one another if you happen to have both products and a SaaS offering seems like a good solution to removing the payment processing burden on your company. Something I don’t like about them is that they obfuscate their pricing by not publishing it clearly on their site and having to go through a “quote” process to even see it. This may be an indication that they’re more interested in larger businesses than small indie developers. See this tweet from Adam Wathan when he was looking to migrate their company to Paddle.

@PaddleHQ Hey folks! We ($xxx,xxx/mo) are looking to migrate from our current setup to a Merchant of Record and would love to chat with someone to make sure Paddle can do what we need and figure out pricing. What’s the best way to talk to a sales person?

— Adam Wathan (@adamwathan) October 1, 2020

Pricing for Paddle is (apparently, according to the thread) between 5-6% + a charge fee.

Develop It Yourself

These systems integrate and extend your existing payment provider. The customer purchase remains between your business and the customer. This means you account for every individual transaction (along with associated taxes) that comes through it and deal with any potential chargebacks yourself. Your business will need to do more work in terms of integration.

Stripe

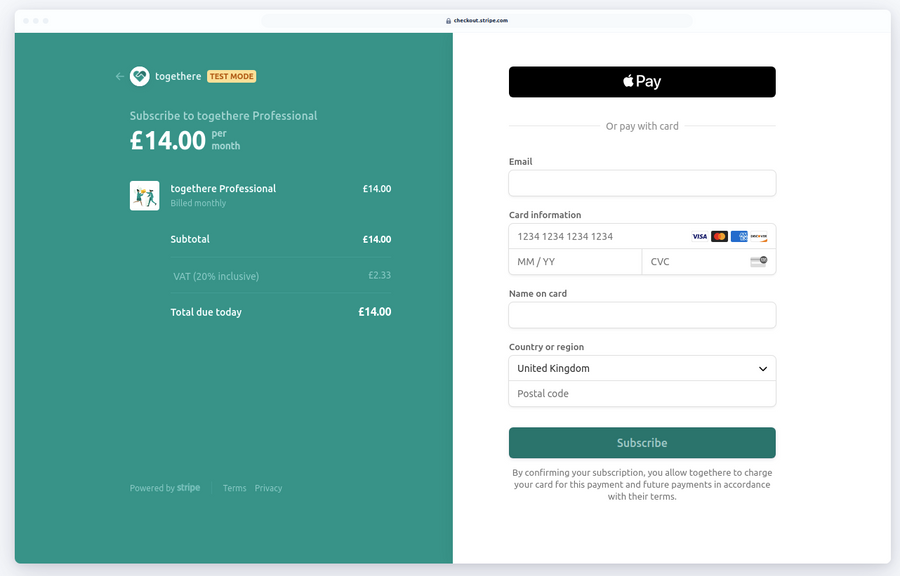

Stripe is by and far the most well regarded payment provider around by developers. It’s extremely flexible and has a whole host of apis and existing libraries available for different languages for integration.

The main problem here is by using stripe on it’s own, you have to handle everything yourself as Stripes core offering offers no tax or vat calculations. It gives the ability to charge tax at a particular rate, but you need to determine when a tax applies.

The example below shows how their checkout experience applies VAT when the rate has been supplied as part of the Stripe API call.

Stripe also offer a billing solution which includes tools for reducing customer churn and automatic generation of hosted invoices. For a business in the UK, there are government rules over correctly invoicing customers and you’d be subject to these should you opt to use a DIY system.

Stripes pricing is 1.4% + 20p for European cards and 2.9% + 20p for Non-European cards for their core offering, or an additional 0.5% when using Stripe billing.

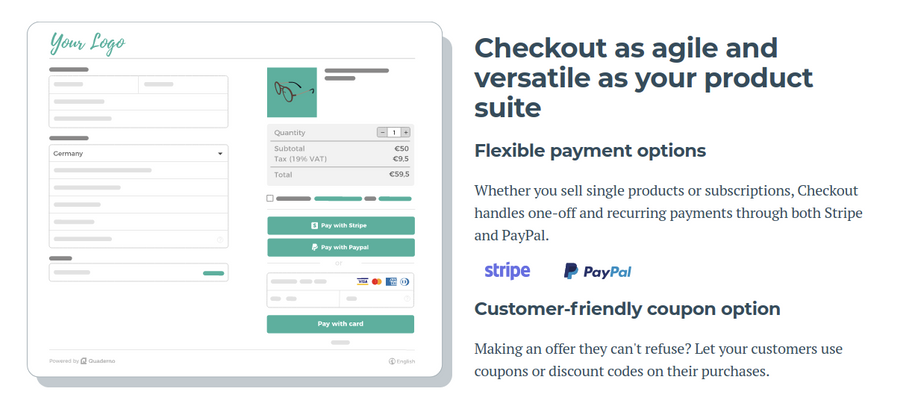

Quaderno

Quaderno is a tool built specifically for handling the complexities of tax. During checkout it looks at your customer location and determines if tax applies for your customers. It interfaces with your existing payment providers and then gives a customisable checkout page for your business. It charges a single fee each month depending on the size, meaning that the only additional charges you’ll have are from your payment provider. Depending on how large your business may mean that you end up paying more than a revenue payment solution before you have many paying customers.

Quaderno’s pricing is additional to a payment provider, ranging from $49 - $149 a month.

Pricing Comparison

Below is an example of pricing a $10 (£7.12) ebook averaging 999 customers each month (with 50% of sales from Europe). It shows the charges for each approach covered here in GBP (£) assuming 1 USD = 0.71 GBP with no conversion charges. I’ve assumed that Quaderno solution is using Stripe as the payment provider.

| Stripe | Quaderno | Paddle | Gumroad | |

|---|---|---|---|---|

| European Transaction Fee (%) | 0.01 | 0.01 | 0.05 | 0.04 |

| Non European Transaction Fee (%) | 0.03 | 0.03 | 0.05 | 0.04 |

| Card Charge Fee (£) | 0.20 | 0.20 | 0.20 | 0.20 |

| European Transaction Fee (£) | 0.30 | 0.30 | 0.56 | 0.45 |

| Non European Transaction Fee (£) | 0.41 | 0.41 | 0.56 | 0.45 |

| European Charges | 149.78 | 149.78 | 277.78 | 224.44 |

| Non European Charges | 202.70 | 202.70 | 277.22 | 223.99 |

| Monthly Platform Fee | 70.39 | 7.12 | ||

| Gross Sales | 7,103.89 | 7,103.89 | 7,103.89 | 7,103.89 |

| Total Fees | 352.48 | 422.87 | 554.99 | 455.56 |

| Net Income | 6,751.41 | 6,681.02 | 6,548.89 | 6,648.33 |

For a $25 (£17.78) ebook, again with all other assumptions remaining the same:

| Stripe | Quaderno | Paddle | Gumroad | |

|---|---|---|---|---|

| European Transaction Fee (%) | 0.01 | 0.01 | 0.05 | 0.04 |

| Non European Transaction Fee (%) | 0.03 | 0.03 | 0.05 | 0.04 |

| Card Charge Fee (£) | 0.20 | 0.20 | 0.20 | 0.20 |

| European Transaction Fee (£) | 0.45 | 0.45 | 1.09 | 0.82 |

| Non European Transaction Fee (£) | 0.72 | 0.72 | 1.09 | 0.82 |

| European Charges | 224.44 | 224.44 | 544.44 | 411.11 |

| Non European Charges | 357.06 | 357.06 | 543.35 | 410.28 |

| Monthly Platform Fee | 70.39 | 7.12 | ||

| Gross Sales | 17,759.72 | 17,759.72 | 17,759.72 | 17,759.72 |

| Total Fees | 581.50 | 651.89 | 1,087.79 | 828.51 |

| Net Income | 17,178.22 | 17,107.83 | 16,671.94 | 16,931.21 |

We can see that fees are significantly more with each of the revenue platforms, though we have to consider the difference of £500 of additional revenue between Stripe and Paddle now means that we have to build a number of additional features, along with comply with worldwide tax laws.

I’ve made this available as a google sheet which you can copy and modify to see how your own payment prices/exchange rates would stack up.

Conclusion

Most of the payment solutions I see bootstrapped businesses use tend to be those using revenue systems rather than a DIY approach. Understandably, most small businesses just don’t want to have to deal with the complexity of international tax rules when selling online. Why delay and build these features when they could be making money? I like to refer to Baremetrics build vs buy calculator for challenges like this which suggests that it will never be worth building a payment solution yourself if it costs even a few days a month to maintain.

Depending on the size of your business a DIY approach may acceptable. For a individual like myself, who is likely to generate a small amount of product revenue initially this is still a pain and representative of a lot of accounting work for individual transactions. In the estimates I gave, the additional revenue between Stripe and Paddle totalled £500 / month. This hardly seems worth the huge amount of additional complexity that it introduces, both in terms of the additional software now needed or the laws around tax you now need to worry about.